Contents:

One of the most popular TP strategies is to use resistance/support levels as profit targets. However, remember that you will be able to get profit only by following your strategy and basing your predictions on the accurate market analysis. Stop-loss and take-profit levels are two fundamental concepts that many traders rely on to determine their trade exit strategies depending on how much risk they are willing to take. These thresholds are used in both traditional and crypto markets, and are especially popular among traders whose preferred approach is technical analysis. Support and resistance levels are the areas where the trend is most likely to change its direction. The value will likely reach one of such levels, but whether or not it will break it out is unclear.

One very popular way to take profit in a successful trade is to put an order in toclose a position when the next support or resistance level is reached. This is one of the easiest ones to do, as long as you understand support resistance. The theory on this of course is the value will be able to avoid any whipsaw that the Forex market may produce as it undulates along its course. Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks.

II. Daily range levels

Limit Order → This is an order type that does not open a trade immediately. Instead, it tells a broker to open a trade when the price reaches a certain level. For example, if the stock is trading at $20 and after some analysis, you find that the stock will reach a buy zone at $23, you can direct your broker to do that. TP orders automatically close a trade, whereas it can continue yielding profits as the value moves on in the predicted direction. Opening a trade again involves spread-related expenses. There’s a signal to open a short position in both cases.

Fu Wang Foods posts 55% profit growth in July-December – The Daily Star

Fu Wang Foods posts 55% profit growth in July-December.

Posted: Tue, 28 Feb 2023 06:57:26 GMT [source]

Correction goes to level 0.382 and almost touches it. In contrast to the previous candles, the red one has a small body and equal shadows in both directions. Open a trade on the current or next ascending candlestick. Set Take Profit on the correction’s beginning level — 0 as per Fibo grid. There are many strategies on the internet where Take profit levels and SL amounts are calculated for 4-digit quotes, and some calculators do that as well. At LiteFinance, the values are calculated for 5-digit quotes.

What is a profit taking strategy?

It’s better to make a partial closure of your https://forexarena.net/ and lock in profits than trying to make the most of the trend and then regret doing so. It’s hard to use TP orders during high volatility periods, for example, when fundamental stats are released. A drastic price fluctuation in either direction can trigger a TP order placed too close. Take Profit should be placed before opening a position and not corrected before closing a position. As long as a trade isn’t open, the trader is more focused and cold-blooded. L2 and L1 levels are target points for placing Take Profit.

Australian Q4 Business Indicators Survey: Inventories, Sales, and Company Profits; First Impressions – Action Forex

Australian Q4 Business Indicators Survey: Inventories, Sales, and Company Profits; First Impressions.

Posted: Mon, 27 Feb 2023 03:32:34 GMT [source]

Order cancellation can be performed at any https://trading-market.org/ by the trader, or is performed automatically when the position is closed otherwise. Trade entries and trade exits should be generated by two different trading strategies when day trading. As day trading is very challenging, an element of individual discretion based on experience is also helpful in picking profitable entries and exits. You simply decide you will exit any trade still open after a certain period of time.

How to calculate stop-loss and take-profit levels

At this time, you can set a trailing stop for the order. In MT4, you can use the trailing stop function to set take profit. The reader may wonder, what is the connection between the trailing stop and take profit? So let’s explain the use and meaning of trailing stops.

In either case, they took the trade because there was more upside potential than downside risk. Establishing where to get out before a trade even takes place allows a risk/reward ratio to be calculated on the trade. Just as important as the profit target is the stop- loss. The stop-loss determines the potential loss on a trade, while the profit target determines the potential profit. Ideally, the reward potential should outweigh the risk.

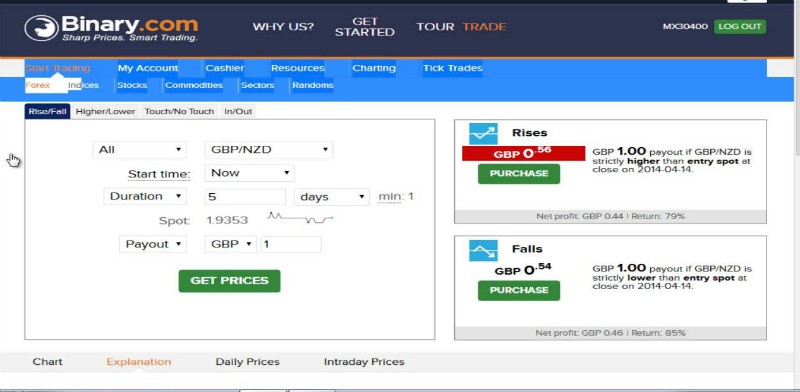

The position is closed automatically with profit when the price reverses and touches the Trailing Stop level. A Take Profit order is a type of order set together with Market Execution or Pending orders. It is used to place profit targets once the price level reaches a target price. This review deals with Take Profit orders and teaches you to place them on different platforms, use them in various trading systems, including complex instruments like trading CFDs, and calculate their levels. Many trading system developers also use take-profit orders when placing automated trades since they can be well-defined and serve as a great risk management technique. Forex trading itself is all about predicting market trends, but the market movements are so volatile that any analysis is only a possibility.

How do I find out my profit on the trade?

The commission is automatically calculated based on your stake, symbol, and the multiplier you choose. Cryptocurrencies Trade with leverage on the price movement of popular crypto-fiat pairs. DTrader A whole new trading experience on a powerful yet easy to use platform.

The first reason is because many people think of them as the same as trade entries, just in reverse. The logic here is that a good long entry is the same as a good exit from a short trade. This is not really true, because we are usually looking for different things in our trade entries than we are in our exit. One of the most common questions I hear from new traders is “When should I take profit when I have an open trade performing well? AxiTrader Limited is amember of The Financial Commission, an international organization engaged in theresolution of disputes within the financial services industry in the Forex market. There is no single profit taking strategy that is better than the rest.

The disadvantage of that method is that you don’t know the trend’s exact extent. Or, on the contrary, a Take profit order might automatically close your trade too early when the trend is your friend. Take-profit orders are best used by short-term traders interested in managing their risk.

About FXCM

Using trailing stops or time-based exits are two good and popular exit strategies. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. AxiTrader is not a financial adviser and all services are provided on an execution only basis.

Update it to the latest version or try another one for a safer, more comfortable and productive trading experience. Remember though that there are a lot of factors that can affect the price during a day. ATR shows the historic movement, but the real one can differ. In this article, we will explain what Take Profit is and how to set this kind of orders to grab the maximum profit. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading office with us.

A key point to add here is that stop-loss orders can only limit losses; they cannot cancel losses completely. In case you lose all of your funds, there is no way to recoup your losses; you are out of the game. Needs to review the security of your connection before proceeding. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible. Trading Point of Financial Instruments Limited provides investment and ancillary services to residents of the European Economic Area and the United Kingdom.

- Now that you understand why profit taking strategies are so important to implement into your own trading, dive into some of the best profit taking strategies below.

- Take-profit (T/P) orders are limit orders that are closed when a specified profit level is reached.

- If you were bearish on the news, it would have been very smart to exit your position immediately.

- You can also set a Take Profit order in Depth of Market .

If you marry this with a serious resistance area, this gives you two very strong reasons to consider exiting the trade. Conversely, if you are short a currency pair and see a hammer candlestick, this could be a trade that is about the work against you. This is especially true if support is to be found in the same area.

If you make some pips, you must retain them rather than give them back to the market. Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

The process includes usinghttps://forexaggregator.com/s of different assets, and through calculations with different formulas determines when a currency pair can reach its peak price, and when it could possibly decrease too much. Support and resistance levels are areas on a price chart that are more likely to experience increased trading activity, be it buying or selling. At support levels, downtrends are expected to pause due to increased levels of buying activity.

Leave a Reply