Contents:

For example, 24 biscuits at $2.40 would be $0.10 per biscuit. For example, let’s say you’re looking at a quart of milk for $1.25 and a gallon of milk for $4.29. There are 4 quarts in a gallon, so you could adjust the price for the quart of milk by multiplying it by 4. To purchase a gallon of milk in individual quart-size bottles, you’d pay $1.25 x 4, which is $5.00. Look on the label to check the amount of product in the container. The quantity is normally listed on the bottom right corner of the package.

How Much Does a F1 Car Cost. Combination of Technology and Style – Tech Critter

How Much Does a F1 Car Cost. Combination of Technology and Style.

Posted: Wed, 05 Apr 2023 01:47:13 GMT [source]

The manufacturing costs are uncertain as they are affected by production processes and purchases of raw materials. Businesses allocate the expected cost to an item using a standard costing system. Some examples of fixed costs include lease and rental payments, insurance, salaries, utility bills, and loan repayments. You won’t have to pay more rent because you’re producing more, nor will you have to upgrade to a more expensive insurance policy.

Featured Businesses

For example, if a cash and cash equivalents produces 1,000 widgets at a total cost of $10,000, the average cost per widget would be $10 ($10,000 ÷ 1,000 widgets). This means that on average, it costs the company $10 to produce each widget. Direct material, direct labor, and manufacturing overhead are the three primary categories of product costs. Product costs are the expenses incurred in the production of a product. Materials, labor, production supplies, and factory overhead are all included in these prices. The cost of materials and labor influences the cost of production.

Proposed mixed-use development near Metro station approaches … – Loudoun Times-Mirror

Proposed mixed-use development near Metro station approaches ….

Posted: Thu, 13 Apr 2023 01:00:00 GMT [source]

Fixed costs are the opposite of variable costs—these are the costs that remain the same regardless of how many products you’re producing or selling to your customers. After all, you will need to pay these fixed costs in addition to any variable costs you incur as a result of increased production. Businesses can use the formula to determine their break-even point, which is the point at which total revenue equals total cost.

Additional Resources

Broadly, the https://1investing.in/ cost of production is composed of two parts, as expressed by the following formula. To calculate the cost per unit, you must also consider your material cost. Work with a supplier located near your location or a low-cost manufacturer. You can lower the overall overhead costs by finding an area with affordable rent and lease. Consider leasing your workspace during a recession and assess your service charges.

Let’s say the product is a 6-roll pack of toilet paper for $4.59. To get the unit price, you’d divide $4.59 by 6 to get $0.77. To be able to compare this cost to cost of another strip of different size you need to calculate cost per unit of volume. For example, if you use millimeters for dimensions, you need the cost per cubic millimeter for first and for the second strip. At sales of 50 units the business generates profits of $150.

Average Cost Quiz – Teste dein Wissen

Is the percent of your selling price that goes to your profits, after covering fixed costs. For example, if you sell the product for $10.00 with variable costs of $4.00 and fixed costs of $3.50 per unit, then the net margin, or profit, is $2.50 per unit, or 25%. Total Fixed Costs are costs that occur independent from your production. Fixed costs have no direct impact on production as you have to bear these costs even if your production continues at zero.

Protecting Your Self-Storage NOI as Industry Demand and Rates … – Inside Self-Storage

Protecting Your Self-Storage NOI as Industry Demand and Rates ….

Posted: Thu, 13 Apr 2023 05:02:08 GMT [source]

This pricing method considers what your customers believe are the benefits of your product. If they think your product’s benefits warrant a higher price than a similar product, they’ll pay more. An engaging brand story and communicating what makes your product stand out from the crowd can support a higher price. Consumers are often willing to pay a premium for specialty and gourmet products.

Markup Percentage Calculation

Let’s say a firm has to spend $2000 a month for rent and it does not matter whether the firm is active that month or not. Average Cost, also called average total cost , is the cost per output unit. We can calculate the average cost by dividing the total cost by the total output quantity . Instead of looking at your fixed costs as a whole, you can break your fixed costs down on a more granular level. Your average fixed cost can be used to see the level of fixed costs you’re required to pay for each unit you produce.

Besides, it can also help you to fix a reasonable price and generate profits. Understanding the cost of each unit you produce is essential to ensure your business remains profitable. Total variable cost is a good number to start with, but you may want to divide your total variable cost by the number of units you produce to find the average cost per unit. With both the total variable cost and the average cost per unit, you can predict changes in variable costs based on increases in production. This includes additional marketing costs you may incur as a result of increased production.

In this case, you might decide that the higher-quality toilet paper is a better value for you. Keeping inventory for an extended period – whether completed goods or raw resources – may quickly add up. Will you hire a fulfillment house, or will you transport your products yourself?

But if sales are through the roof, variable costs will rise drastically. What your company should aim for are low variable costs that enable larger margins so your business can be more profitable. Like you did with the fixed costs, use your profit and loss account, to sum up, your variable expenses. These costs could include direct labor, delivery and shipping cost, raw material costs, and sales commissions. For the ultimate production planning and budgeting purposes, understanding the total cost structure of your business is quite important. To determine the total manufacturing cost per unit, you need to divide your total manifesting costs by the total number of units produced during a given period.

It helps them determine the profitability of a product or service. They can also use it to decide pricing, production level, and cost-cutting decisions. Principally, the total fixed cost does not change over a shorter period. So the total cost of production is primarily driven by the change in average variable price per unit. It takes into account all the costs incurred in the production process or when offering a service. For example, assume that a textile company incurs a production cost of $9 per shirt, and it produced 1,000 units during the last month.

- Having a finger on the pulse of your business metrics will be crucial to happily serving your customers for years to come.

- As you can see from the calculator above, calculating cost per unit includes a few main components.

- But when the relationship is approximately linear, the least-squares regression line is calculated.

- Unit labour costs are defined as the average cost of labour per unit of output produced.

- Fixed costs are business expenses that remain constant no matter how much is produced.

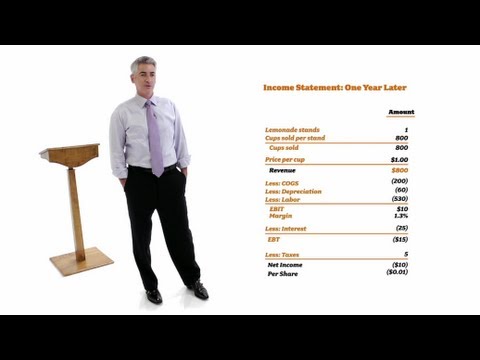

If you divide that by roughly 30 days in a month, you’ll need to sell 20 cups of coffee per day in order to break-even. The break-even point is the number of units you need to sell to make your business profitable. Your income statement should serve as a blueprint for finding ways to make your business more profitable.

It is this margin that the retailer uses to cover the costs of their store operations and net profits. Sam’s Sodas is a soft drink manufacturer in the Seattle area. He is considering introducing a new soft drink, called Sam’s Silly Soda. He wants to know what kind of impact this new drink will have on the company’s finances.

Average Cost equals the per-unit cost of production which is calculated by dividing the total cost by the total output. On the first look, we can see that the Average Total Cost Function has a U-shape and decreases up to a quantity and increases after this quantity . The average fixed cost decreases with the increasing quantity and the average variable cost has an increasing path in general. For lower levels of output, the spreading effect dominates the diminishing returns effect, and for higher levels of output, the contrary holds. At low levels of output, small increases in output cause large changes in average fixed cost.

Leave a Reply